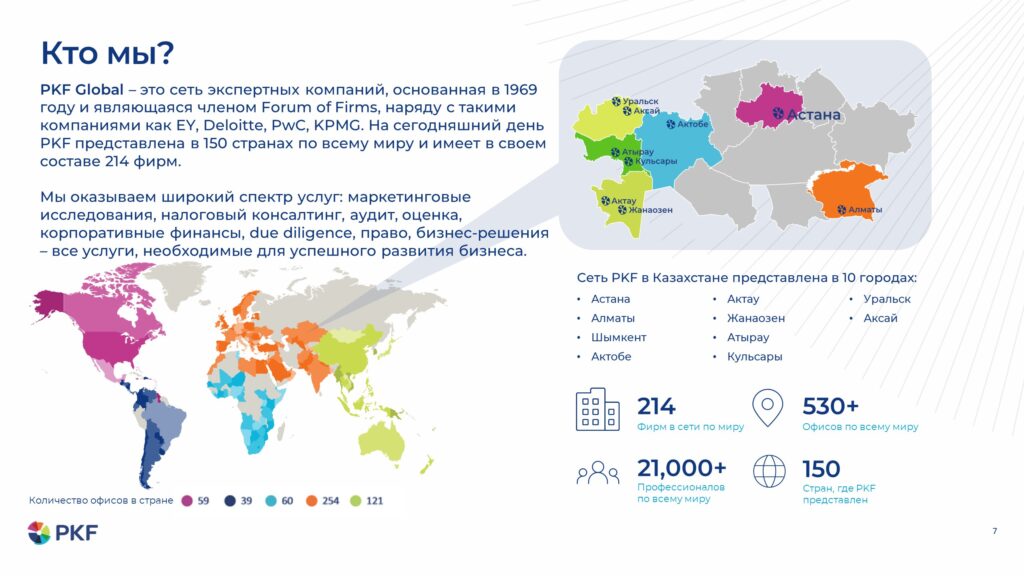

Due diligence with PKF Valuation of Property: a new level of business review

2025.02.05Farid Bakhtiozin has joined PKF Valuation of Property team – an experienced specialist in due diligence. We warmly welcome Farid to the team!

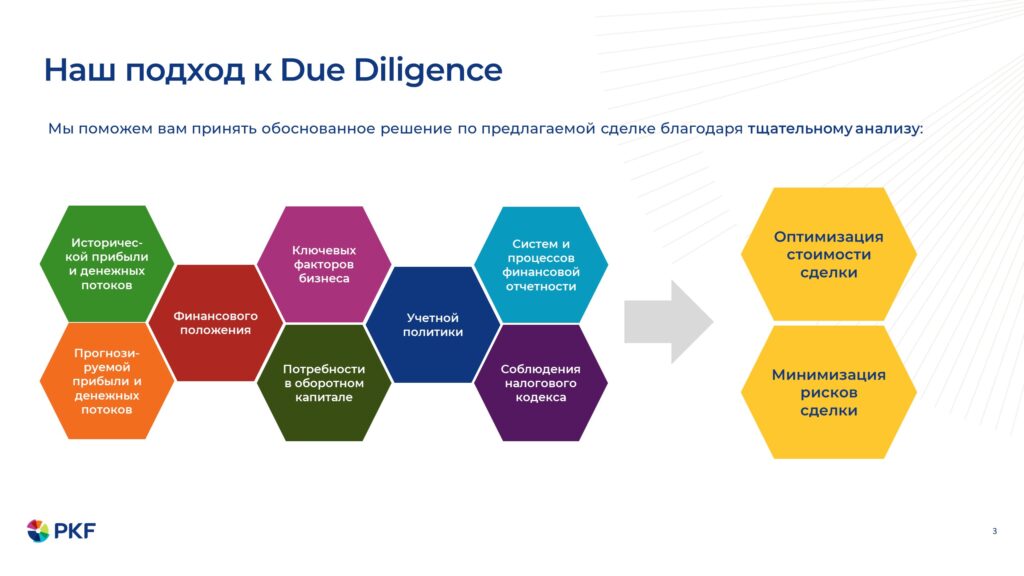

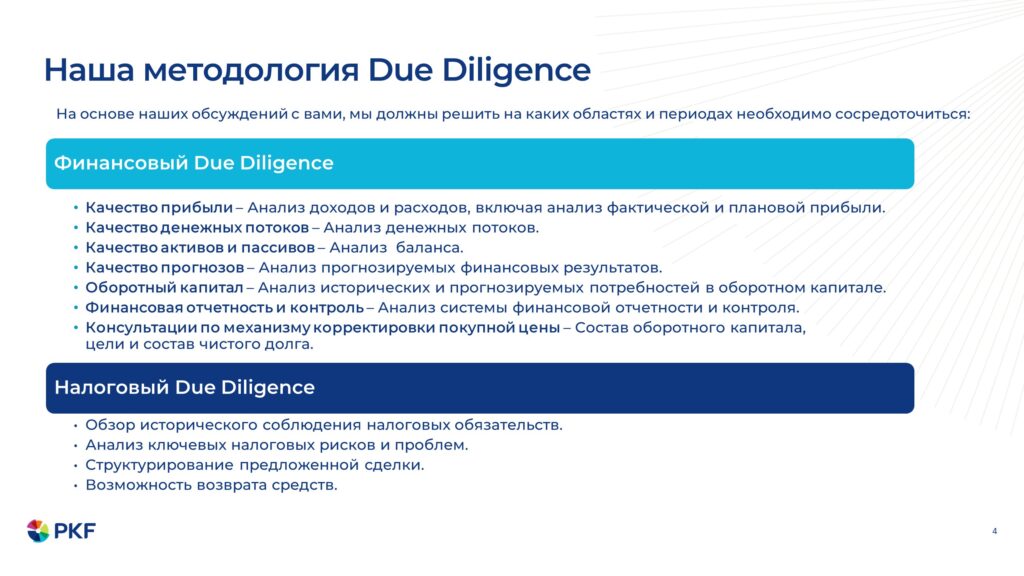

Financial due diligence is an audit that helps to understand the real state of a business before a deal. Our methods make it possible to identify risks, assess the commercial attractiveness of a company, and create a reliable foundation for decision-making.

Due diligence – what does it provide?

Financial due diligence is the process of studying and assessing a company’s key risks and opportunities.

WE WILL HELP YOU:

- Form an objective view of the acquisition or investment target;

- Conduct a comprehensive check of the company before purchase.

YOU WILL RECEIVE:

- Objective information about the real situation of the investment target;

- A substantiated assessment of the commercial attractiveness of the investment target.

AS A RESULT OF THE STUDY, YOU WILL GAIN THE FOLLOWING ADVANTAGES:

- Complete information to make a decision on acquiring a company or refusing the deal;

- The possibility of reducing the deal price considering identified risks;

- The opportunity to eliminate detected risks before a change of main participants/shareholders and management, when later elimination may be difficult or impossible.